|

|

|

Select your vehicle to see available coverage options:

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

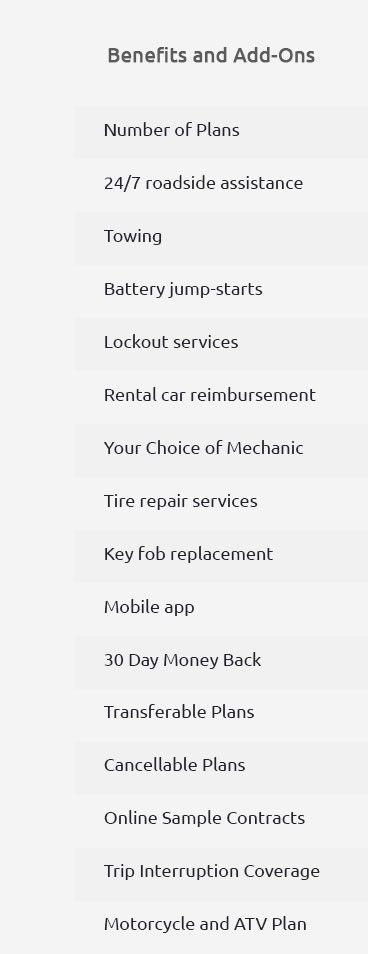

Breakdown Insurance Cover: A Comprehensive Coverage GuideIn the bustling cities and vast landscapes of the U.S., having reliable breakdown insurance cover can provide immense peace of mind. Whether you're commuting through New York's busy streets or enjoying a scenic drive across California, knowing that your vehicle is protected from unexpected repair costs is invaluable. This guide explores how breakdown insurance can save you money, what it typically covers, and how it compares to other popular options like extended auto warranties. Understanding Breakdown Insurance CoverBreakdown insurance cover is designed to protect you from the high costs associated with vehicle repairs due to mechanical failures. It's an excellent option for those who want an extra layer of security beyond the manufacturer's warranty. What Does Breakdown Insurance Cover?Typically, breakdown insurance covers a wide range of vehicle issues including:

It's important to read the terms carefully to understand what specific parts and systems are covered. Some policies even include additional benefits such as towing services and rental car coverage. Benefits of Breakdown InsuranceOpting for breakdown insurance offers several advantages:

These benefits ensure that you're never caught off guard by unexpected vehicle issues, providing financial security and peace of mind. Breakdown Insurance vs. Extended Auto WarrantiesWhile both breakdown insurance and extended auto warranties aim to protect you from repair costs, there are some differences to consider:

If you're interested in exploring extended warranty options, consider checking out a Mazda extended auto warranty to understand the specific benefits for Mazda vehicles. How to Choose the Right CoverageWhen deciding between breakdown insurance and an extended auto warranty, consider the following:

Obtaining an online extended auto warranty quote can also help you compare costs and find the best plan for your needs. Frequently Asked QuestionsUnderstanding your options and choosing the right breakdown insurance cover can make all the difference in ensuring your vehicle remains in top condition without unexpected expenses. Whether you're navigating the roads of Texas or exploring the scenic routes in Oregon, having the right protection can provide the security you need. https://www.hippo.com/learn-center/equipment-breakdown-coverage

Equipment breakdown insurance covers your appliances, heating and air conditioning systems and other home equipment when they break down because of mechanical ... https://www.progressivecommercial.com/business-insurance/business-owners-policy/equipment-breakdown-coverage/

Equipment breakdown insurance, also known as boiler and machinery insurance coverage, helps pay for sudden and accidental damage to your business's mechanical, ... https://www.allstate.com/resources/business-insurance/equipment-breakdown-coverage

The equipment breakdown coverage in a business insurance policy can help pay for repairs to broken equipment. Learn how adding this coverage to your policy ...

|